How to estimate import duties and taxes for your orders

Mateo FY

Last Update il y a 2 ans

We manufacture and ship all our custom creations from Buenos Aires, Argentina, to almost anywhere in the world through FedEx. Depending you the shipping address you set for your order, the customs of the destination country might apply import duties and taxes to your shipment. Each country has an entirely different way to charge for abroad purchases. Don't panic! Here you have a guide to estimate them using Simply Duty, a simple web import duty calculator.

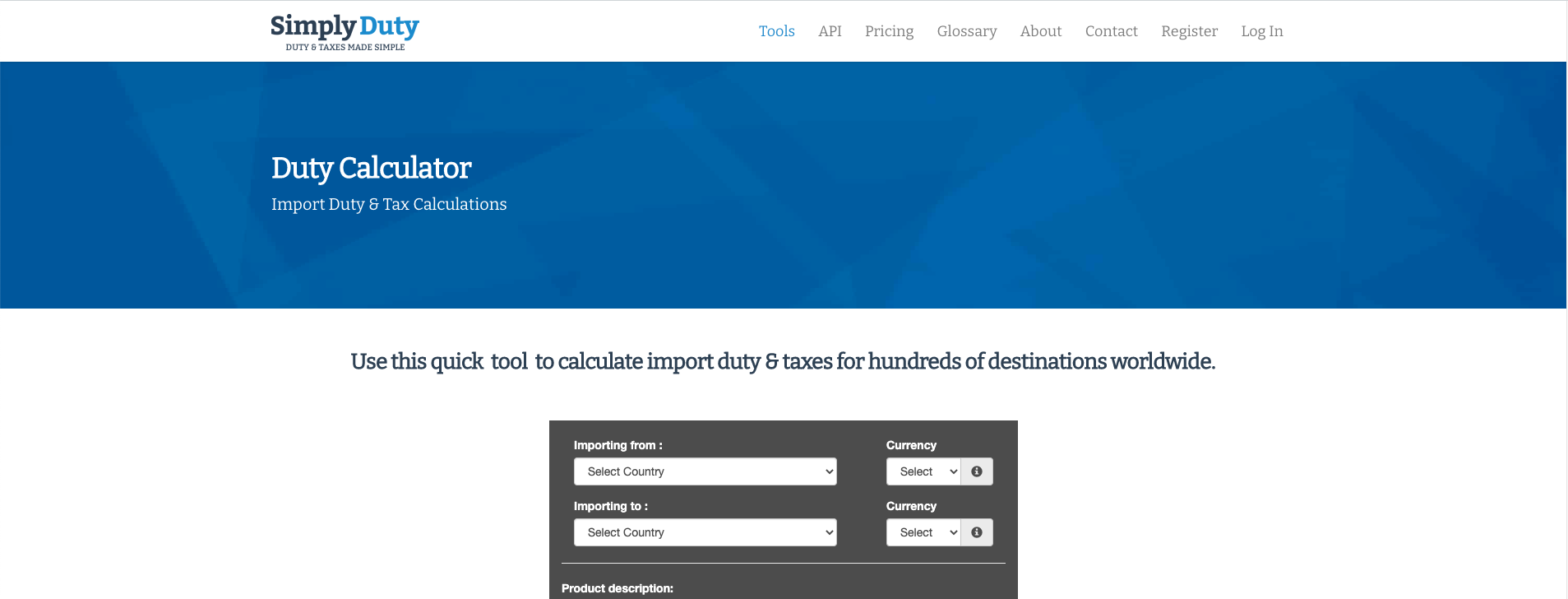

Step 1: Enter Simply Duty

Click here to enter the website and follow the next steps.

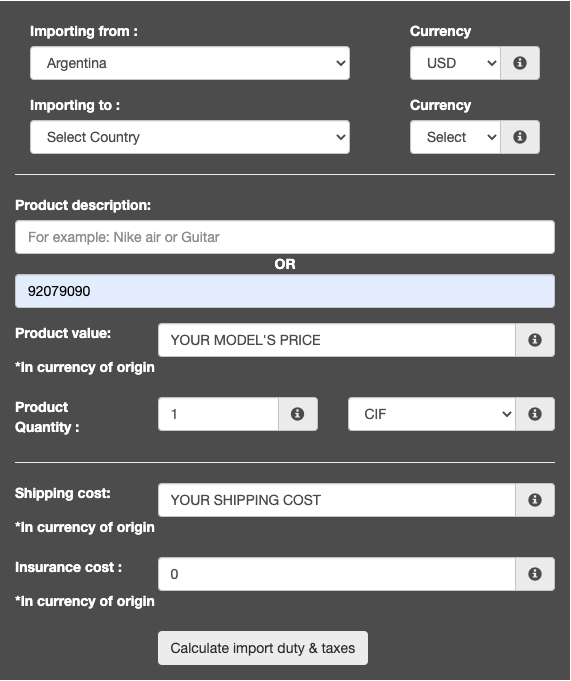

Step 2: Fill the form

Check the following information to fill the form properly.

Importing from: Argentina / Currency: USD

Importing to: Destination country / Currency: Destination currency

Product description not needed, instead use the HS Code in the box under that one: 92079090

Product value: Place the price of your order (without shipping)

Product quantity: 1

Shipping cost: Place the shipping cost calculated at checkout

Insurance cost: 0

Step 3: Hit the button

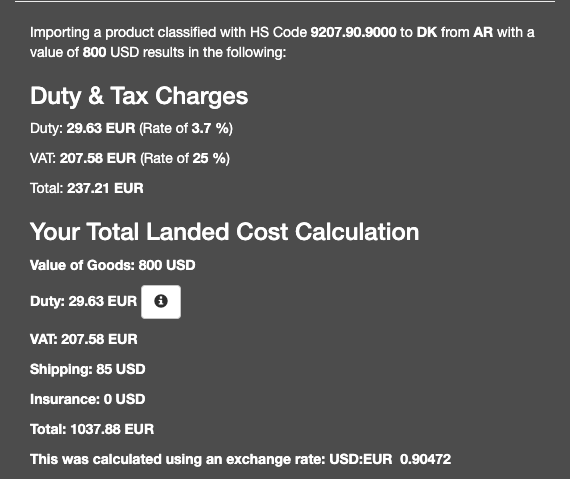

Once you filled out the form, just click the button below the form. The import duty and tax estimation will appear below the form.

That's all for this guide. If you have any troubles estimating your import duty and taxes don't hesitate to let us know. We'll be happy to help you out.